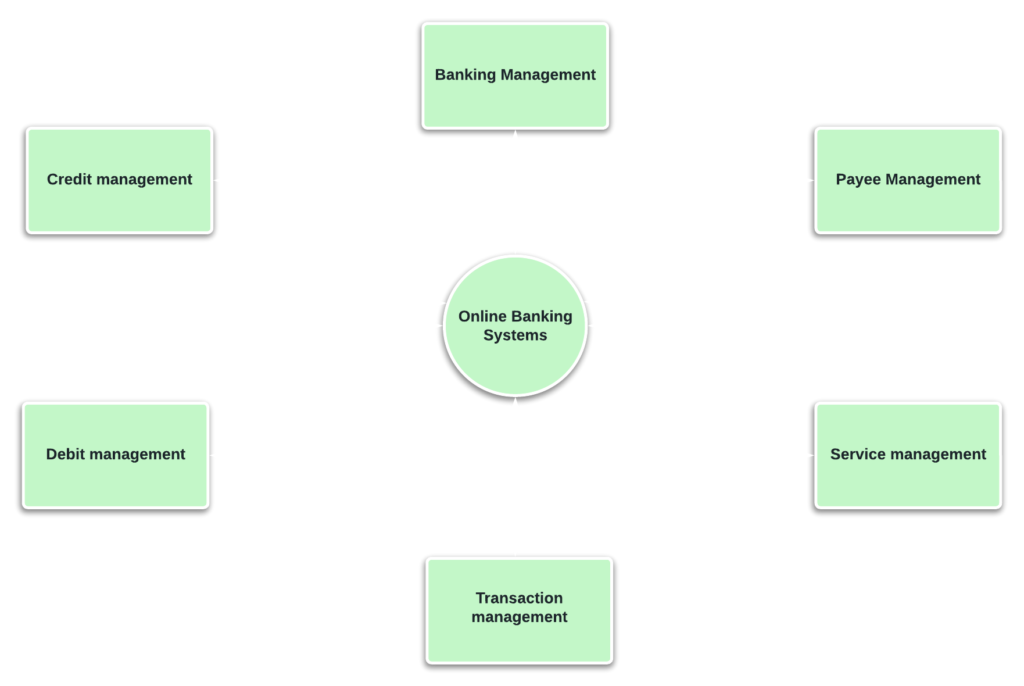

The Zero Lebel Data Flow Diagram of Online Banking System

This comprehensive Internet Banking Zero Level DFD provides an insightful glimpse into the intricate process flow of the cutting-edge internet banking system. Deliberately crafted to be visually appealing and easily digestible, this diagram captures the essence of the system’s core operations, captivating the attention of discerning stakeholders, including prominent financial institutions, debit service providers, and valued payees.

The key entities showcased within this illustrious diagram include:

- Banking management: A network of esteemed financial institutions meticulously woven into the fabric of this digital ecosystem. These venerable establishments administer and oversee customer accounts, serving as the bedrock of trust and reliability. It also includes the management of all other banking needs of clients such as Login: The impregnable gateway, shrouded in layers of impenetrable security, safeguarding customers’ digital sanctums. This pivotal process validates user identities, employing robust authentication mechanisms, be it traditional username/password verifications or cutting-edge biometric safeguards, ensuring unwavering account security.

- Credit and Debit management: A dynamic duo of financial prowess, orchestrating the delicate ballet of credits and debits with finesse and precision. They seamlessly handle a myriad of transactional activities, ranging from deposits and withdrawals to seamless payment transactions.

- transaction management: The veritable gateway to financial fluidity, meticulously overseeing the secure and swift transfer of funds. This vital component ensures the seamless movement of monetary assets, unfettered by geographical limitations while adhering to robust security protocols.

- Payees Management: The esteemed beneficiaries of this digital realm, encompass a diverse range of deserving recipients. From diligent merchants to trusted service providers, these esteemed entities receive payments with grace and gratitude, enriching the lives of customers and fostering lasting relationships.

- Service management: The beating heart of this online banking ecosystem, an extensive catalog of indispensable financial services at customers’ fingertips. This veritable treasure trove encompasses balance inquiries, statement generation, swift bill payments, and holistic account management, empowering customers with unrivaled convenience and financial control.

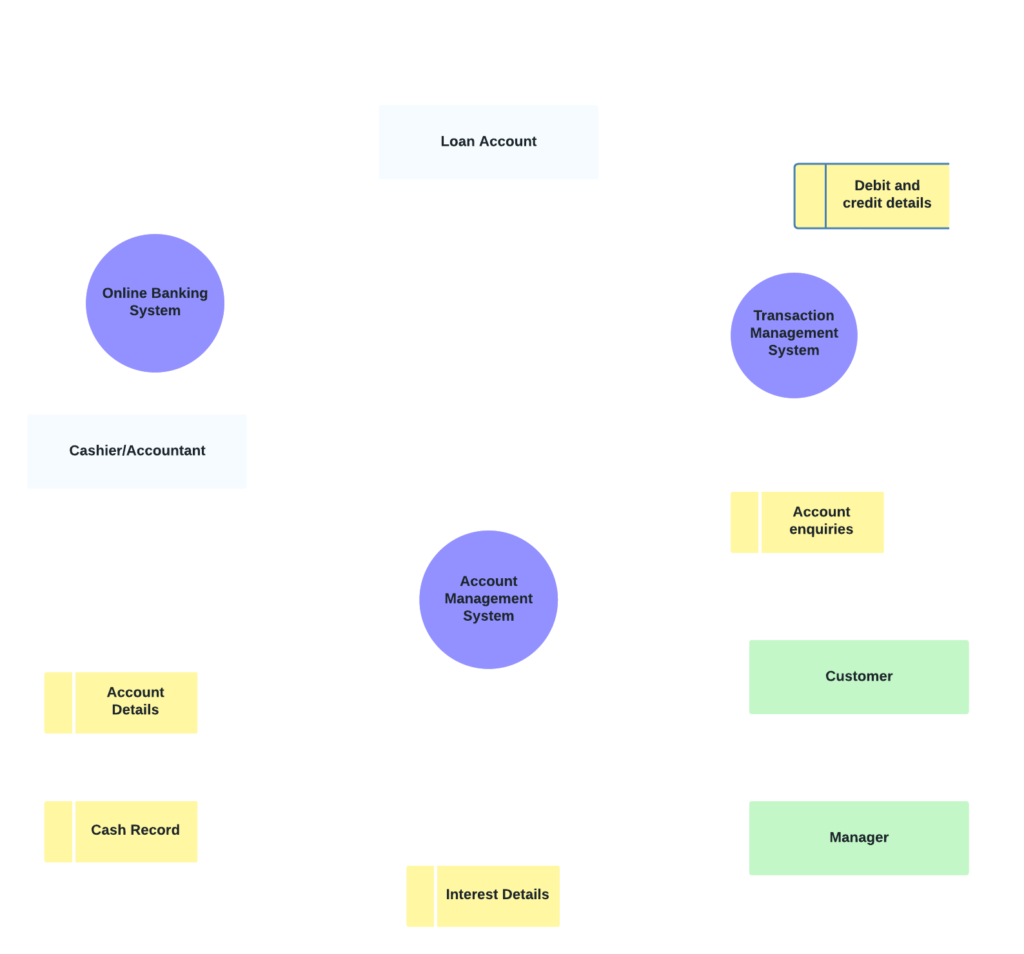

High Lebel Overview of Data flow diagram in Online Banking System

This high-level DFD illustrates the data flow within the online banking system, encompassing key components such as Loan Accounts, the Online Banking System, Transaction Management Systems, and the Account Management System. It provides an overview of the various processes involved in loan management, transaction processing, and account inquiries, presenting a holistic view of the system’s functionality.

Loan Account:

The Loan Account component handles loan-related processes, including loan approval, payment management, refinancing, and access to loan account information. It interacts with the Online Banking System to facilitate seamless loan management for customers.

Online Banking System:

The Online Banking System serves as the central hub, facilitating a wide range of banking operations and customer interactions. It manages the flow of data and processes between various system components and external entities. The Online Banking System interacts with the Loan Account, Transaction Management Systems, and Account Management System to ensure smooth operation and information exchange.

Transaction Management Systems:

The Transaction Management Systems component encompasses the management of debit and credit details, as well as account inquiries. It handles the processing of financial transactions, ensuring accuracy, security, and compliance. Within this component, specific processes include transaction validation, authorization, and recording.

Account Management System:

The Account Management System plays a vital role in customer account administration and support. It consists of the Cashier/Accountant, who manages customer queries and executes account-related requests, such as handling debit or credit transactions. The Account Management System facilitates seamless communication between customers, the Manager, and the Online Banking System.

Data flows within the system include:

Loan Approval Request: The flow of loan approval requests from customers to the Loan Account component, enabling the assessment and approval of loan applications.

Payment Processing: The movement of payment data, including debits and credits, between the Transaction Management Systems and the Online Banking System, ensuring accurate and secure transaction processing.

Account Information Access: The flow of account details from the Account Management System to the Online Banking System, enabling customers to access their account information securely.

Cash Record Updates: The transmission of cash-related information from the Cashier/Accountant within the Account Management System to ensure accurate cash management and record-keeping.

Interest Details: The communication of interest-related information from the Loan Account component to customers, providing transparency and updates on interest rates and calculations.

Customer Requests: The data flow from customers to the Account Management System, including transaction requests and inquiries, allowing customers to interact with their accounts seamlessly.

Manager Monitoring: The flow of data from the Manager within the Account Management System to monitor security measures, compliance, and overall system integrity.

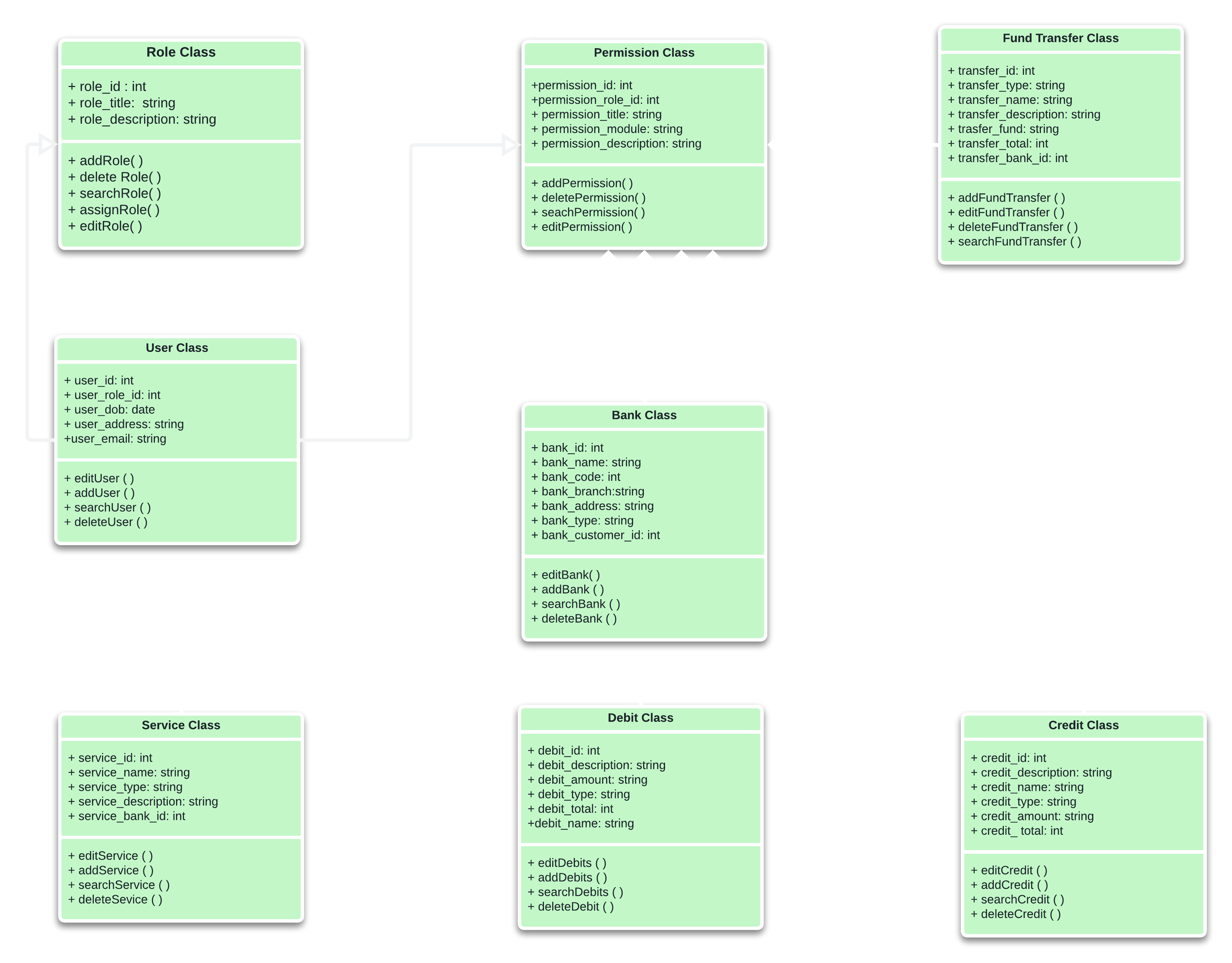

Class Diagram of Online Banking System

The structure of an Internet Banking class, its properties, actions (or methods), and the relationships between objects are all described in the Internet Banking Class Diagram. Banks, Credit, Debits, Fund Transfers, Services, and Users are the key categories of online banking.

1. Banks Class:

Description: The Banks class represents the entity responsible for managing all the operations related to banks within the Internet Banking system. It serves as a central hub for bank-related functionalities, such as adding new banks, updating bank information, retrieving bank details, and handling inter-bank transactions. The Banks class encapsulates the business logic and processes specific to banking operations.

2. Credit Class:

Description: The Credit class handles the management of credit-related operations within the Internet Banking system. It encompasses functionalities such as processing credit transactions, calculating interest rates, generating credit statements, and managing credit limits for customers. The Credit class ensures smooth and secure handling of credit activities, adhering to relevant banking regulations and policies.

3. Debits Class:

Description: The Debits class focuses on managing debit-related operations within the Internet Banking system. It encompasses functionalities such as processing debit transactions, updating account balances, generating debit statements, and handling debit reversals or cancellations. The Debits class ensures accurate and efficient management of debit activities, maintaining the integrity of customer accounts.

4.Fund Transfers Class:

Description: The Fund Transfers class is responsible for managing all operations related to fund transfers within the Internet Banking system. It includes functionalities such as initiating transfers between accounts, verifying transfer status, recording transaction details, and ensuring secure and timely movement of funds. The Fund Transfers class ensures the seamless transfer of funds while maintaining transactional transparency and security.

5. Services Class:

Description: The Services class represents a crucial component within the Internet Banking system, managing a range of banking services provided to customers. It encompasses functionalities such as balance inquiries, statement generation, bill payment processing, account management, and other value-added services. The Services class ensures a seamless and user-friendly banking experience, empowering customers to conveniently access and utilize various services.

6. User Class:

Description: The User class serves as a central entity for managing all user-related operations within the Internet Banking system. It encapsulates functionalities such as user authentication, account registration, user profile management, password reset, and user-specific preferences. The User class ensures the security and privacy of user information while enabling seamless interaction with the Internet Banking system.

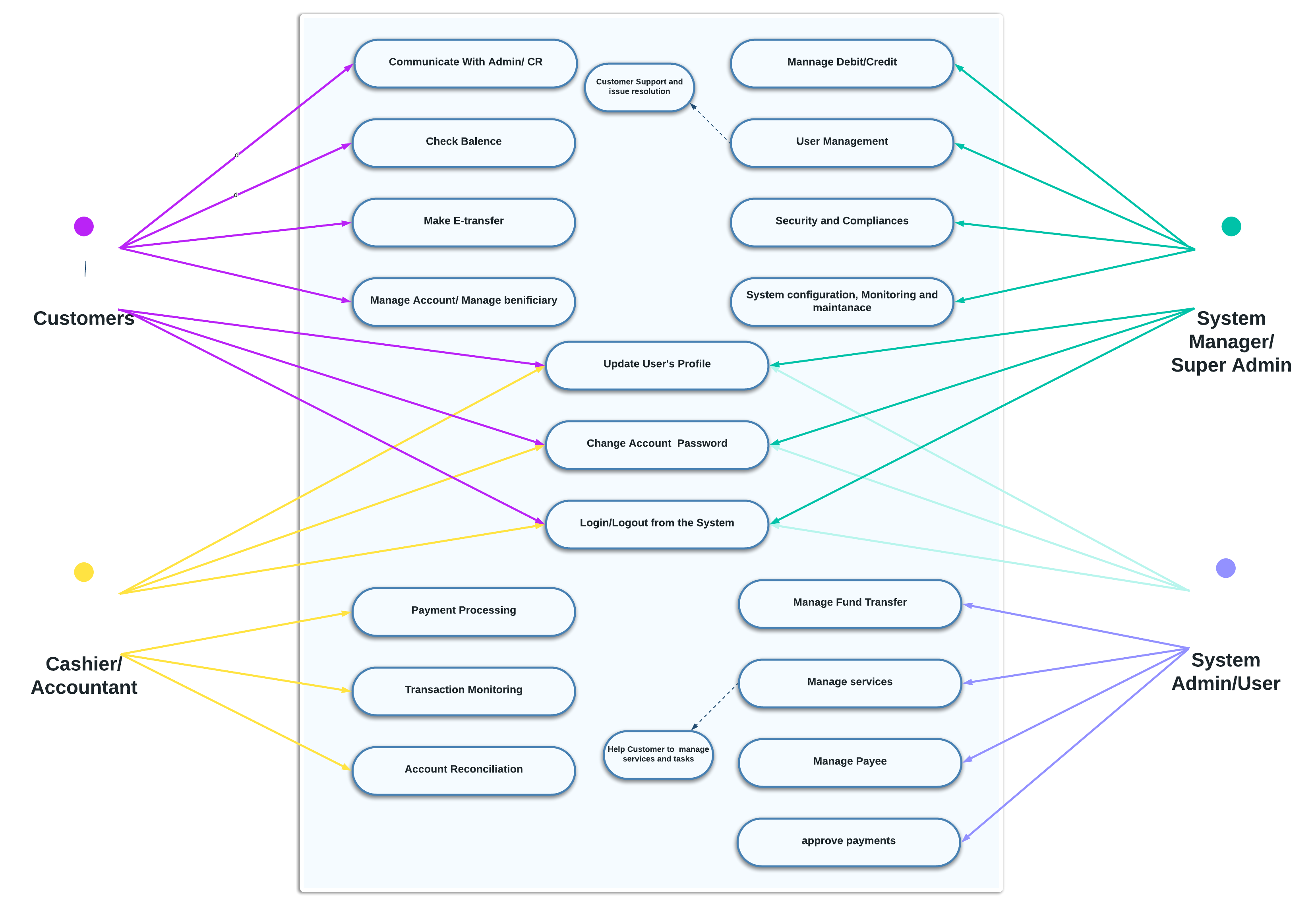

Use Case Diagram of Online Banking System

The Use Case diagram of the online banking system shown below consists of four actors, Customes, cashier or accountant, System admin, and system manager or super admin.

The diagram depicts the functionality and interactions of a system from the perspective of its users/ actors. It provides a high-level view of the system’s behavior and showcases the different use cases (functional requirements) that the system supports.

The use case diagram shown serves as a communication tool between stakeholders, providing a clear and concise overview of the system’s scope, functionalities, and the actors involved. It helps to identify and prioritize use cases, understand the system’s boundaries, and establish a common understanding among stakeholders.